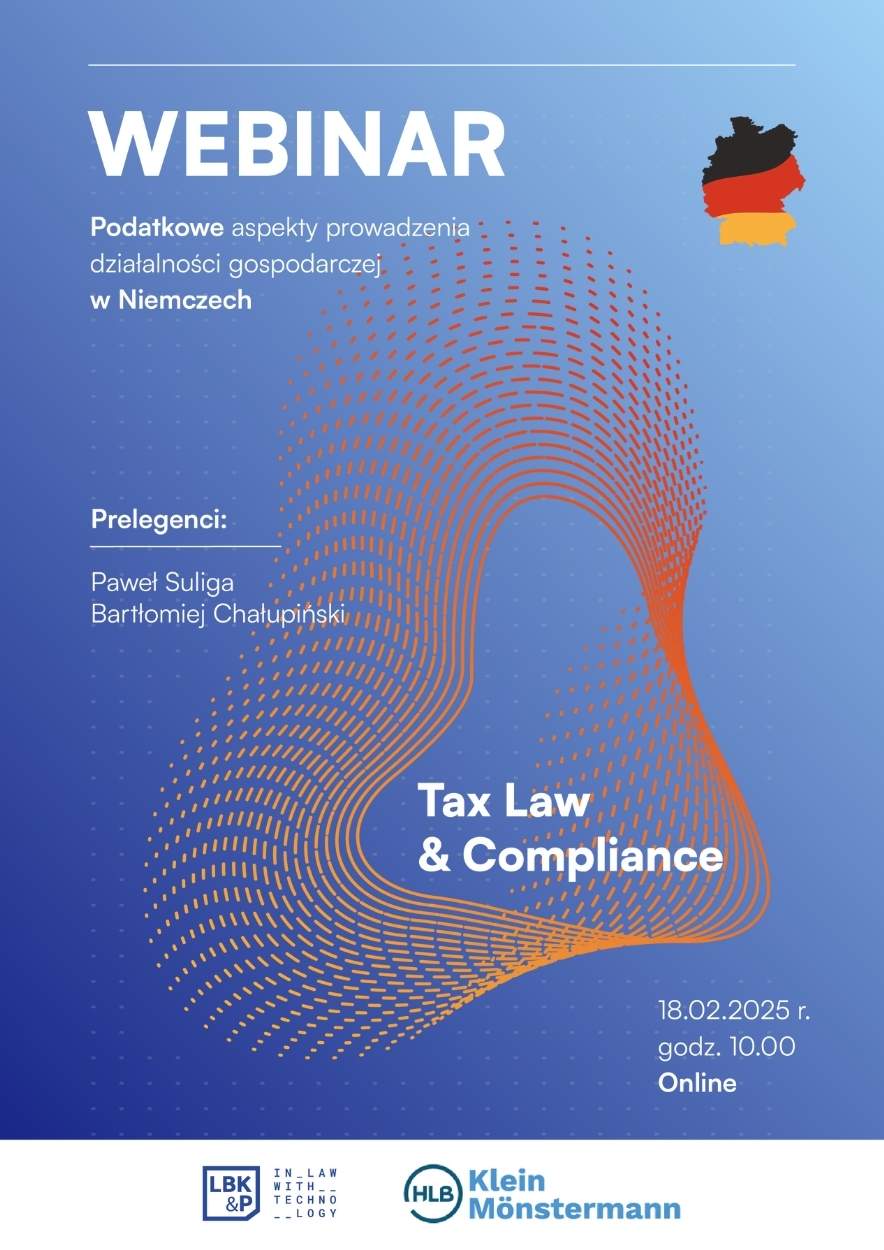

Tax aspects of doing business in Germany

11 February 2025 / News

Dear Sir or Madam,

We would like to invite you to a free webinar on the tax aspects of doing business in Germany, organised by the law firm Leśniewski Borkiewicz Kostka & Partners (LBK&P), in cooperation with the German tax consultancy Dr Klein, Dr Mönstermann International Tax Services GmbH. The event is aimed at both companies just starting out on the German market and those already operating there – especially in the SME sector and large enterprises. Please feel free to forward the invitation to your friends and colleagues who may be interested in the topic of the webinar.

📅 Date: 18 February 2025

⏰ Time: 10:00

📍 Venue: online

During the webinar, LBK&P experts Paweł Suliga (tax advisor in Poland and Germany, recognised expert in German taxes and business law, on a daily basis he provides services in Germany to, among others, Polish companies from the construction industry listed on the Warsaw Stock Exchange) and Bartłomiej Chałupiński (tax advisor in Poland, head of tax @ LBK&P) will discuss key issues regarding tax regulations and obligations related to doing business in Germany.

Agenda:

✅ The most important tax changes in Germany since 01.01.2025.

✅ What tax obligations are associated with setting up a business in Germany?

✅ Documentation and information obligations when conducting cross-border business – what to look out for.

NOTE:

After the webinar, you have the opportunity to take part in a free, 30-minute individual consultation with our experts (separate booking required, limited number of places). To book your consultation, please send an email to rezerwacje@lbplegal.com .

🔗 registration link for the webinar – the link to participate in the webinar and the login details will be sent to you at least 3 days before the event.

Details of the event are also described in the attachment, along with a link to registration.

We look forward to seeing you there!

Attachment for download:

Need help with this topic?

Write to our expert

Articles in this category

MiCA does not cover DeFi. What does this mean for the crypto asset market in the EU?

MiCA does not cover DeFi. What does this mean for the crypto asset market in the EU?AI gigafactory in Poland – a groundbreaking investment in artificial intelligence

AI gigafactory in Poland – a groundbreaking investment in artificial intelligenceLiability for damage caused by autonomous vehicles – who is legally responsible?

Liability for damage caused by autonomous vehicles – who is legally responsible?Jacek Cieśliński in Puls Biznesu on the correct labelling of promotions

Jacek Cieśliński in Puls Biznesu on the correct labelling of promotionsGreen lies, real consequences – greenwashing in the light of the law

Green lies, real consequences – greenwashing in the light of the law